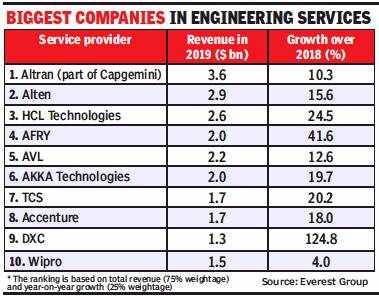

HCL added nearly $600 million to its engineering services business in 2019, taking the total revenue from that business for the year to $2.6 billion. That was a growth of 25%, one of the highest growth rates among the top 10 firms.

TCS was ranked 7th and Wipro 10th.

French firms Altran, now part of Capgemini, and Alten continued to take the first and second spots with revenues of $3.6 billion and $2.9 billion respectively. Swedish engineering firm Avry, Austria based AVL, and Belgium-based Akka Technologies have a little over $2 billion in revenue each. Everest’s ranking is based on total revenue (75% weightage) and year-on-year growth (25% weightage).

European players dominate the engineering services space. At 48%, Europe has the most number of engineering services providers in the engineering services top 50 list. North America’s share rose by 8% from 2018, while Europe and Apac’s shares dropped 4% each.

The top 50 represented more than $45 billion of outsourced spending. The global industry grew 13% in 2019, driven by enterprises’ need for scale, skills, technologies and intellectual property. “We expect engineering service providers to assume an increasingly significant role as enterprises turn to them for high-end engineering activities,” said Akshat Vaid, vice president at Everest Group.

It defines engineering services to include software, embedded, mechanical, and process engineering functions that support the design, development, testing, and management of products, both hardware and software. Enterprises, Everest said, have traditionally kept the design-to-development process in-house, but the need for scalability and rapid innovation has compelled them to consider third-party providers.

Indian IT players have emerged as strong challengers in the engineering services space, growing domain-specific capabilities. Nasscom estimates that engineering services grew 11% in 2019-20, surpassing the IT and BPM industry’s growth of 8.4%.

HCL offers engineering services and solutions across embedded software, mechanical, very large-scale integration (VLSI) design, product lifecycle management (PLM), and software engineering. Last year, it acquired Sankalp Semiconductor for Rs 180 crore to strengthen its position in the semiconductor chip engineering services. Four years ago, it bought Butler America Aerospace for $85 million.

Tech Mahindra last year acquired digital transformation agency Born and US design consultancy firm Mad Pow to strengthen this business. Wipro last year acquired US-based International TechneGroup Incorporated (ITI), a digital engineering and manufacturing solutions company, for $45 million.